The Bellevue School District (BSD) is grappling with a $14.4 million budget shortfall for the 2024–25 fiscal year

Introduction: Not every financial woe, issue, or failure stems from outright fraud. In many cases, they arise from mishandling, mismanagement, or an inability to adapt to changing circumstances—whether it’s shifting enrollment numbers, evolving resource needs, [...]

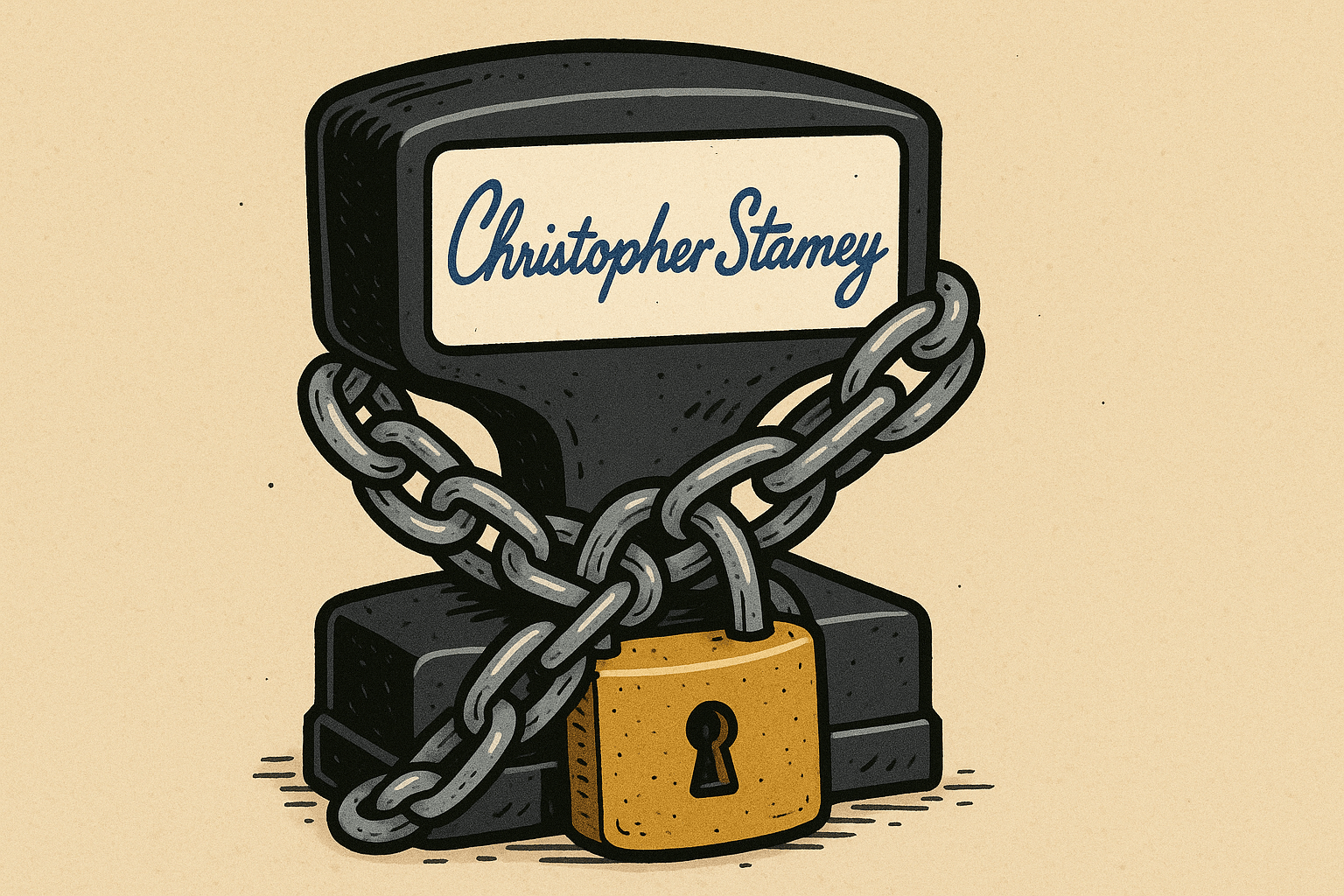

Case Summary: Alleged Misuse of Signature Stamp

What happened:According to documents from the Washington State Auditor, CEO Crystle Stidham allegedly used the signature stamp of CFO Christopher Stamey to approve expenditures totalling $554,971. This was reported by King 5 News based on records obtained [...]

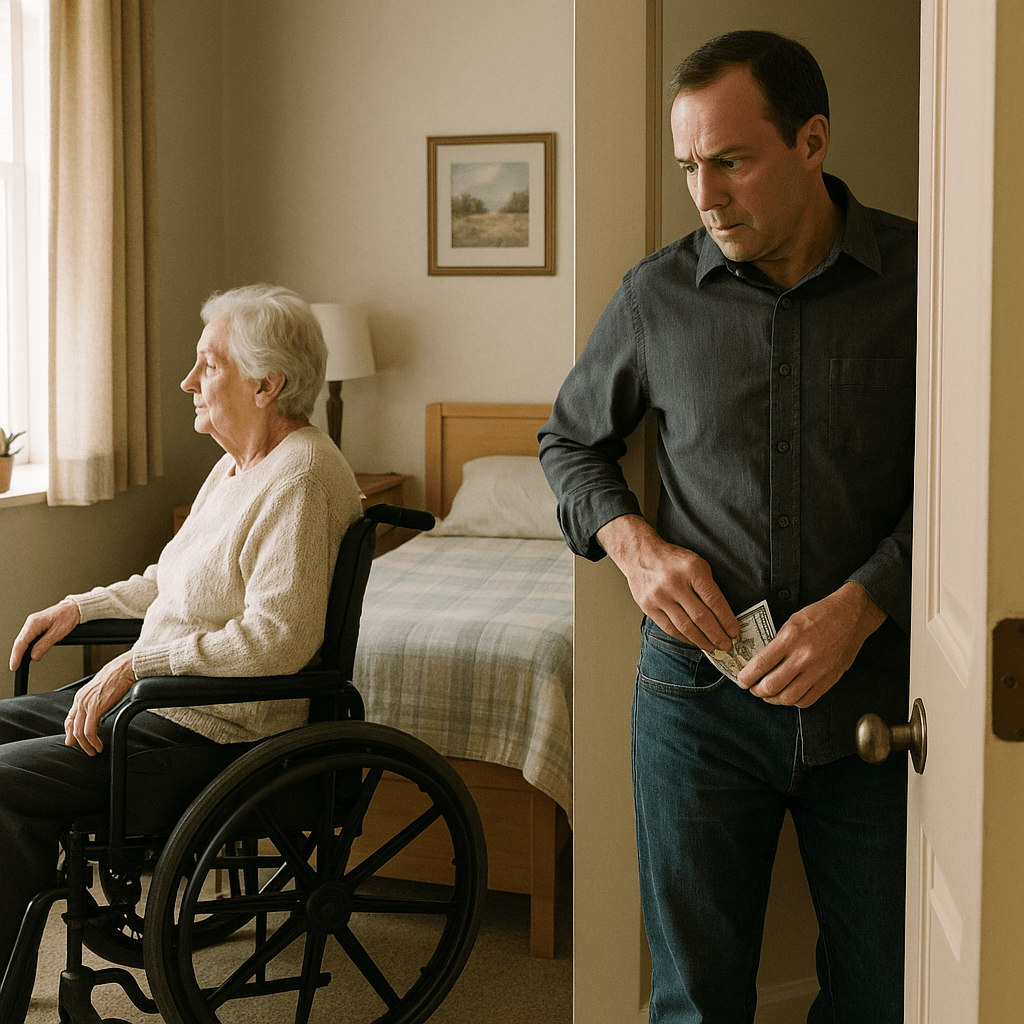

Understanding Self-Dealing and the Weight of Fiduciary Duty

In the world of finance, governance, and elder care, few ethical and legal violations are as serious—or as misunderstood—as self-dealing. Whether you're a company executive, a public official, a board member of a nonprofit, a trustee, [...]

Financial Infidelity: What to Do When Your Retirement and Trust Have Been Compromised

Financial Infidelity: What to Do When Your Retirement and Trust Have Been Compromised A Forensic Accountant’s Perspective The horizon of retirement should be a time of financial clarity and peace. But for many, like the [...]

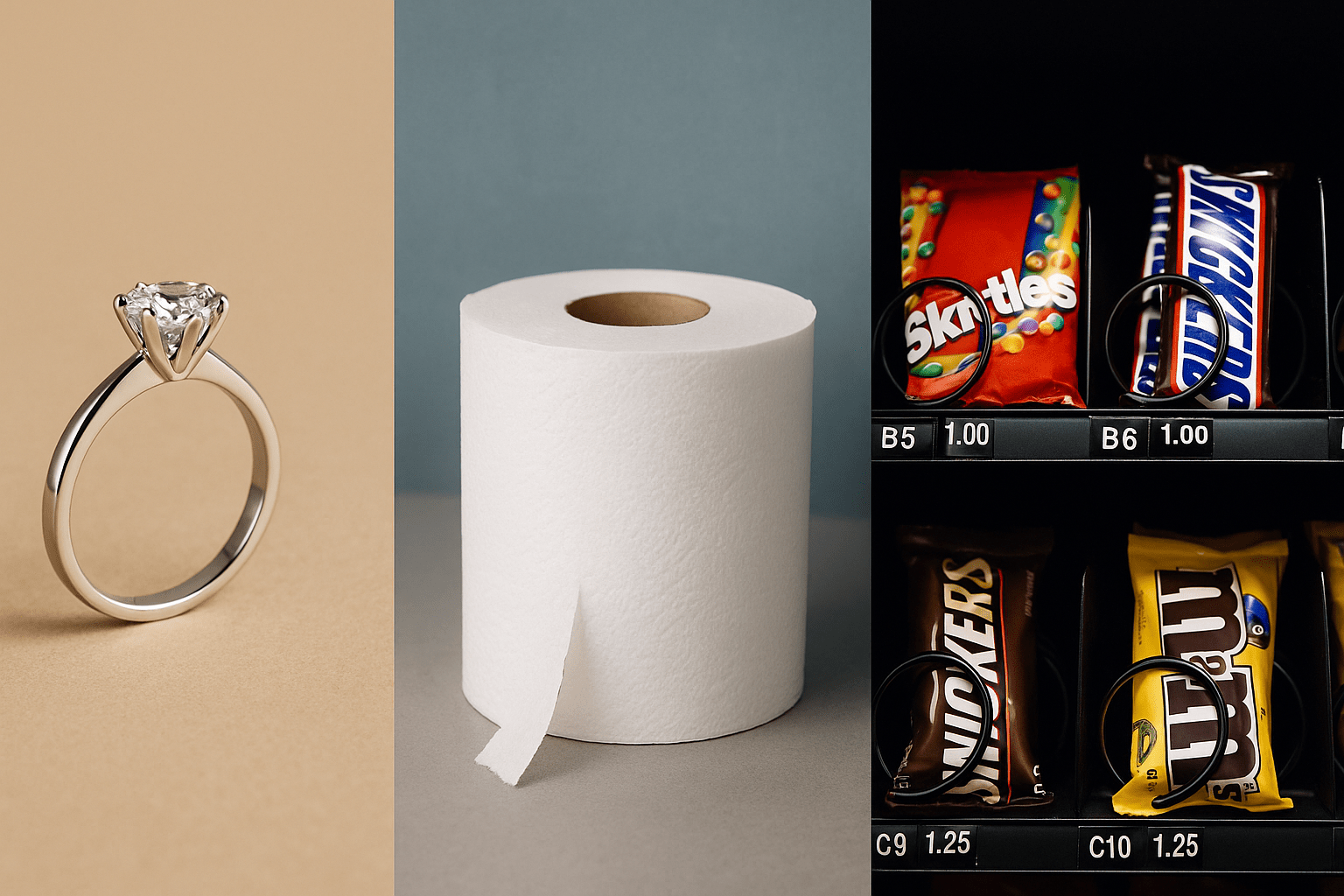

Financial Crimes Come in All Shapes and Sizes: From Diamond Earrings to Paper Towels

Financial Crimes Come in All Shapes and Sizes: From Diamond Earrings to Paper Towels When people think of financial crimes in the workplace, they often imagine grand schemes—phony invoices for tens of thousands of dollars, [...]

Invoice Loophole Allowed Caltrain Employees to Build Hidden Apartments in Stations

June 2025 Financial Crimes California While this news may not pertain directly to our own state, it serves as a powerful reminder of the common "blind spots" that exist within small-scale operational spending across government [...]