Invoice Loophole Allowed Caltrain Employees to Build Hidden Apartments in Stations

June 2025 Financial Crimes California While this news may not pertain directly to our own state, it serves as a powerful reminder of the common "blind spots" that exist within small-scale operational spending across government [...]

Washington State Moves Toward Rulemaking on Paid Family and Medical Leave

On May 29, 2025, the Employment Security Department’s (ESD) Leave and Care Division filed a CR-101 Preproposal Statement of Inquiry, signaling its intent to develop new rules under Washington’s Paid Family and Medical Leave (PFML) [...]

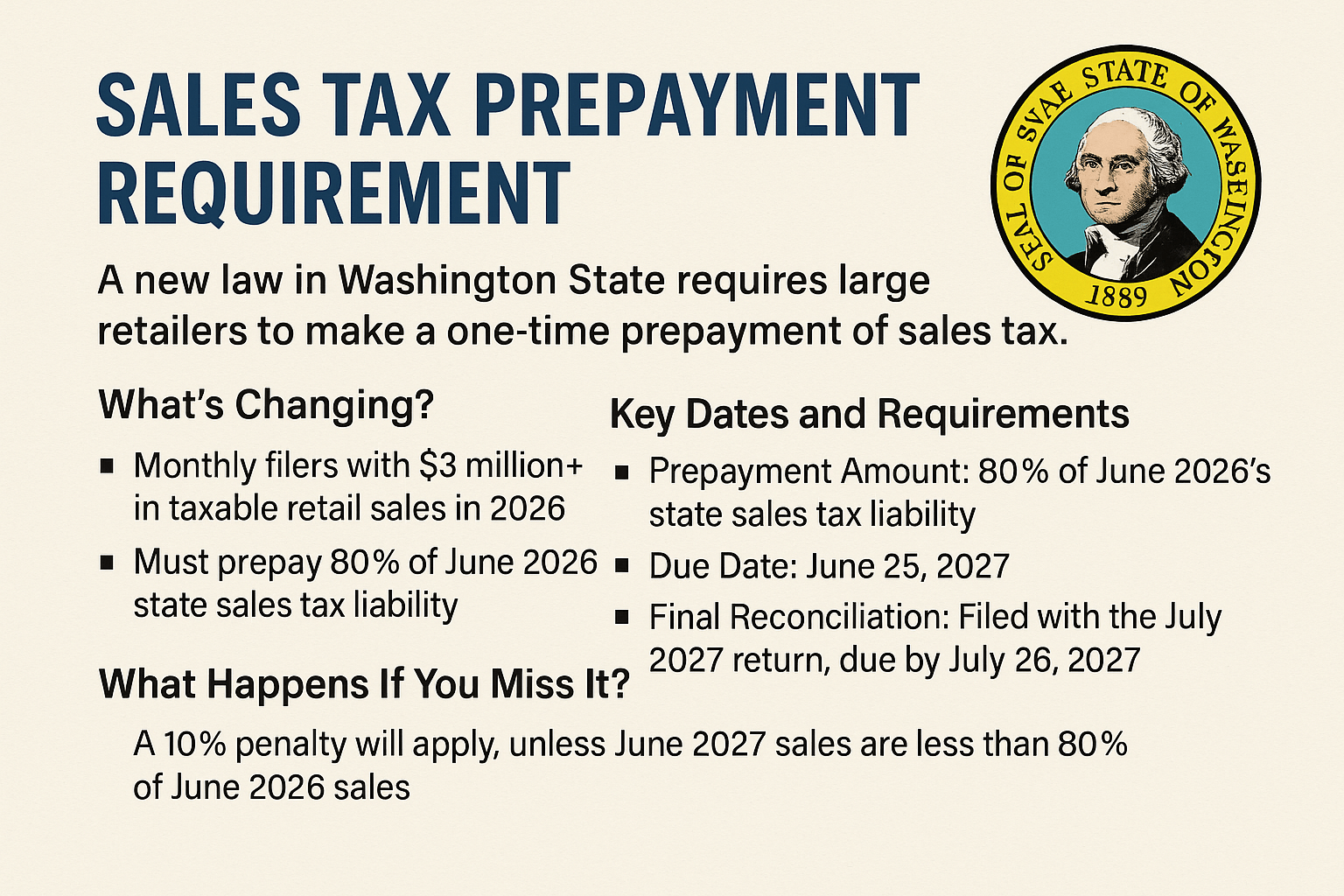

Washington State’s Sales Tax Prepayment Requirement: What Large Retailers Need to Know

Washington State’s Sales Tax Prepayment Requirement: What Large Retailers Need to Know In a sweeping change to Washington State’s sales tax rules, a new prepayment requirement is set to impact larger businesses starting in 2027. [...]

Sales Tax and Business & Occupation Tax Changes – HB 2081 & SB 5814

HB 2081 New Tier for Service Providers: Service businesses with over $5 million in annual gross receipts will now pay a B&O tax rate of 2.1%, up from the previous 1.75% rate applied to those [...]

Governor Ferguson Signs Law Expanding Sales Tax and Raising B&O Rates to Boost State Revenue

Overview On May 21, 2025, Washington Governor Bob Ferguson signed into law a set of fiscal measures aimed at increasing state revenue through the expansion of the sales and use tax base and an increase [...]

Unveiling Hidden Financial Risks: The Imperative of Robust Bank Account Management

Unveiling Hidden Financial Risks: The Imperative of Robust Bank Account Management In our forensic investigations, we've encountered numerous instances where inadequate oversight of bank accounts has led to significant fraud. These cases, spanning various industries [...]