Washington State Floats New Payroll Tax Proposal: What Employers Need to Know

Washington State Floats New Payroll Tax Proposal: What Employers Need to Know Source: https://komonews.com/news/local/new-washington-state-tax-proposal-to-offset-federal-funding-losses-during-trump-administration-economy-taxes-washingtonians-legislation-politics A new payroll-based tax proposal—modeled after Seattle’s JumpStart payroll tax—is expected to take center stage in Olympia this session. The measure, [...]

Former Tacoma Lawyer Sentenced for Embezzling from Elderly Client: A Cautionary Tale for Families and Fiduciaries

Former Tacoma Lawyer Sentenced for Embezzling from Elderly Client: A Cautionary Tale for Families and Fiduciaries Source: https://www.fox13seattle.com/news/tacoma-lawyer-embezzles-elderly-client Financial abuse remains one of the most devastating — and often overlooked — forms of exploitation impacting [...]

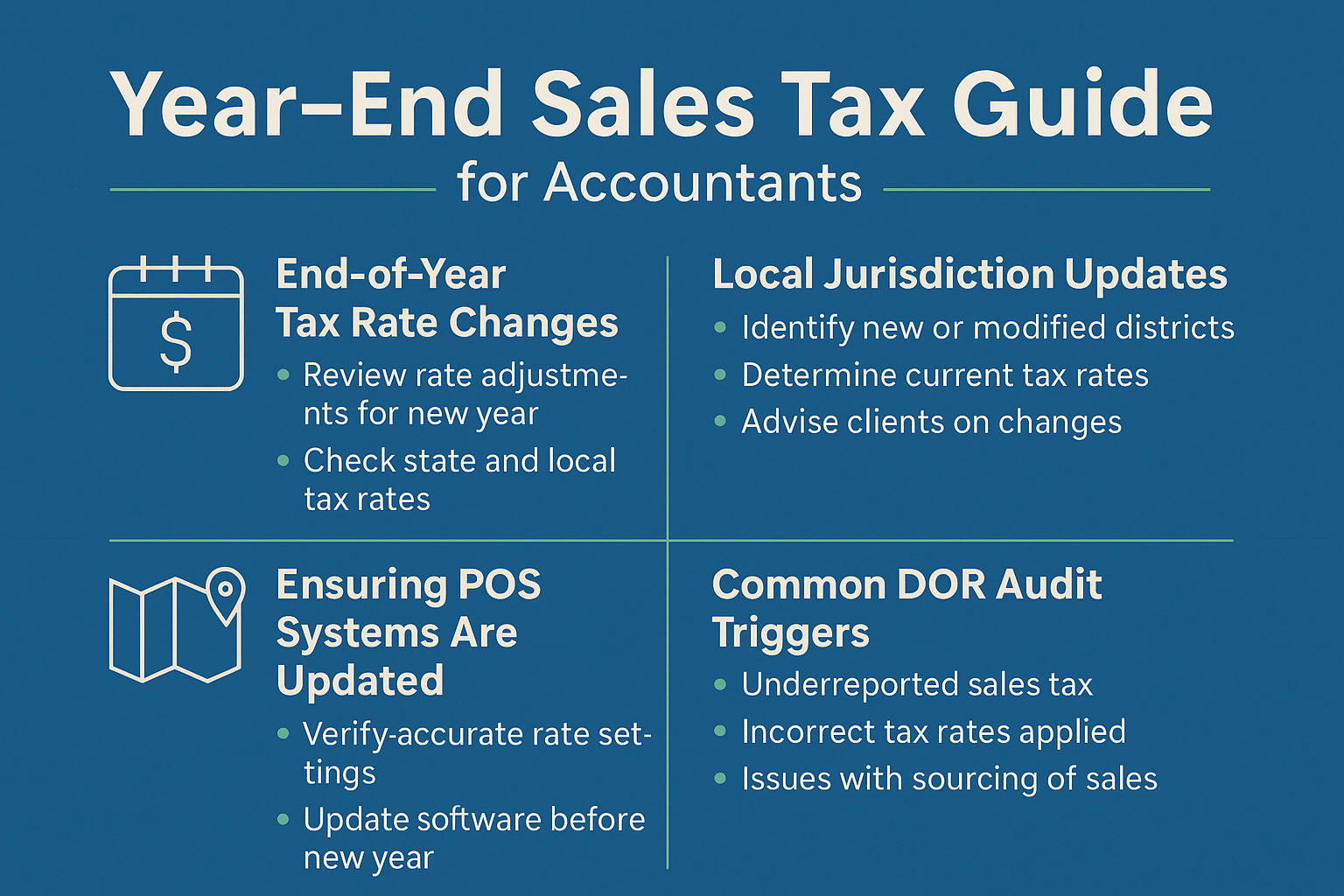

Year-End Sales Tax Reconciliation for Washington State Businesses

Year-End Sales Tax Reconciliation for Washington State Businesses Pivotal Forensic Accounting & Audits — Year-End Sales Tax Guide As the year wraps up, Washington State businesses face a critical task: closing out their sales-tax obligations [...]

New Tax Law Changes for 2025–2026: What Business Owners Need to Prepare For

As year-end planning approaches, business owners in Washington State are facing a variety of federal and state-level tax and compliance changes that will impact payroll, reporting, budgeting, and day-to-day operations. Below is a clear, business-focused [...]

What the End of IRS Direct File Means for Tax Filing (and What to Do Next)

As the 2026 filing season approaches, many U.S. taxpayers should be aware of a significant shift in how they can file their federal income tax returns. The free, government-run electronic filing option known as Direct [...]

UPDATE: Washington Paid Family & Medical Leave Premium Rate Changes Effective January 1, 2026

UPDATE / CORRECTION: Washington Paid Family & Medical Leave Premium Rate Changes Effective January 1, 2026 Beginning January 1, 2026, the Washington Paid Family and Medical Leave (PFML) premium rate will increase to 1.13% of [...]