The Value of a Business Consultant with an Accounting Background

When a business owner thinks of an accountant, they often picture tax season, financial statements, and compliance work. While those services are essential, there’s a powerful advantage when the same professional also operates as a [...]

Car Loan Interest Deduction Under the OBBBA: How to Save on Your Taxes

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, brings a new opportunity for taxpayers to save money. One of its standout provisions is a temporary deduction for interest paid [...]

The True Cost of Delayed Fraud Discovery: A Forensic Accountant’s Perspective

Local Fraud News: Issaquah Police Arrest Local Woman for $630,000 Theft from Employer On July 9, 2025, detectives with the Issaquah Police Department arrested a 57-year-old Issaquah woman for the theft of approximately $630,000 from [...]

The Bellevue School District (BSD) is grappling with a $14.4 million budget shortfall for the 2024–25 fiscal year

Introduction: Not every financial woe, issue, or failure stems from outright fraud. In many cases, they arise from mishandling, mismanagement, or an inability to adapt to changing circumstances—whether it’s shifting enrollment numbers, evolving resource needs, [...]

Case Summary: Alleged Misuse of Signature Stamp

What happened:According to documents from the Washington State Auditor, CEO Crystle Stidham allegedly used the signature stamp of CFO Christopher Stamey to approve expenditures totalling $554,971. This was reported by King 5 News based on records obtained [...]

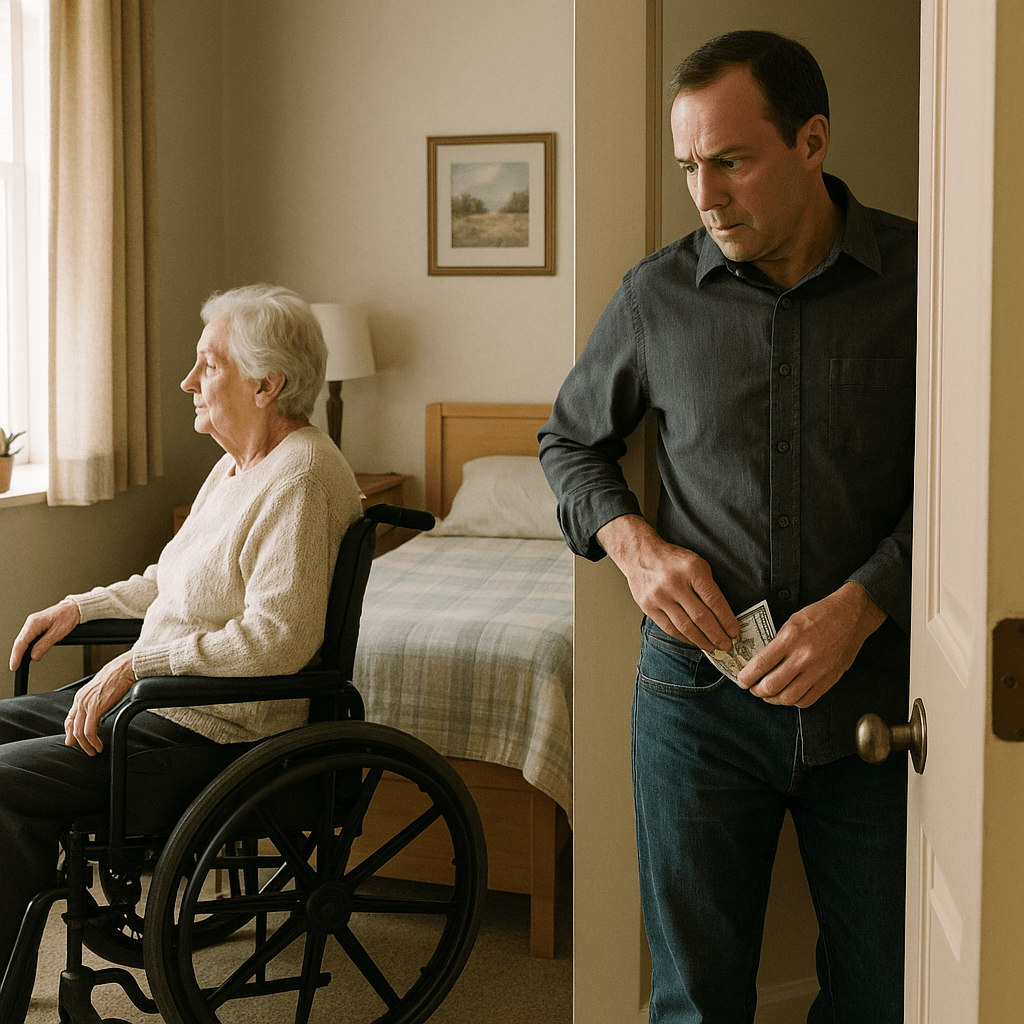

Understanding Self-Dealing and the Weight of Fiduciary Duty

In the world of finance, governance, and elder care, few ethical and legal violations are as serious—or as misunderstood—as self-dealing. Whether you're a company executive, a public official, a board member of a nonprofit, a trustee, [...]