IRS Operations Suspended During Federal Funding Lapse

IRS Operations Suspended During Federal Funding Lapse Notice to Clients — October 2025 As of October 8, 2025, the IRS has suspended most operations due to a lapse in federal appropriations. The majority of IRS [...]

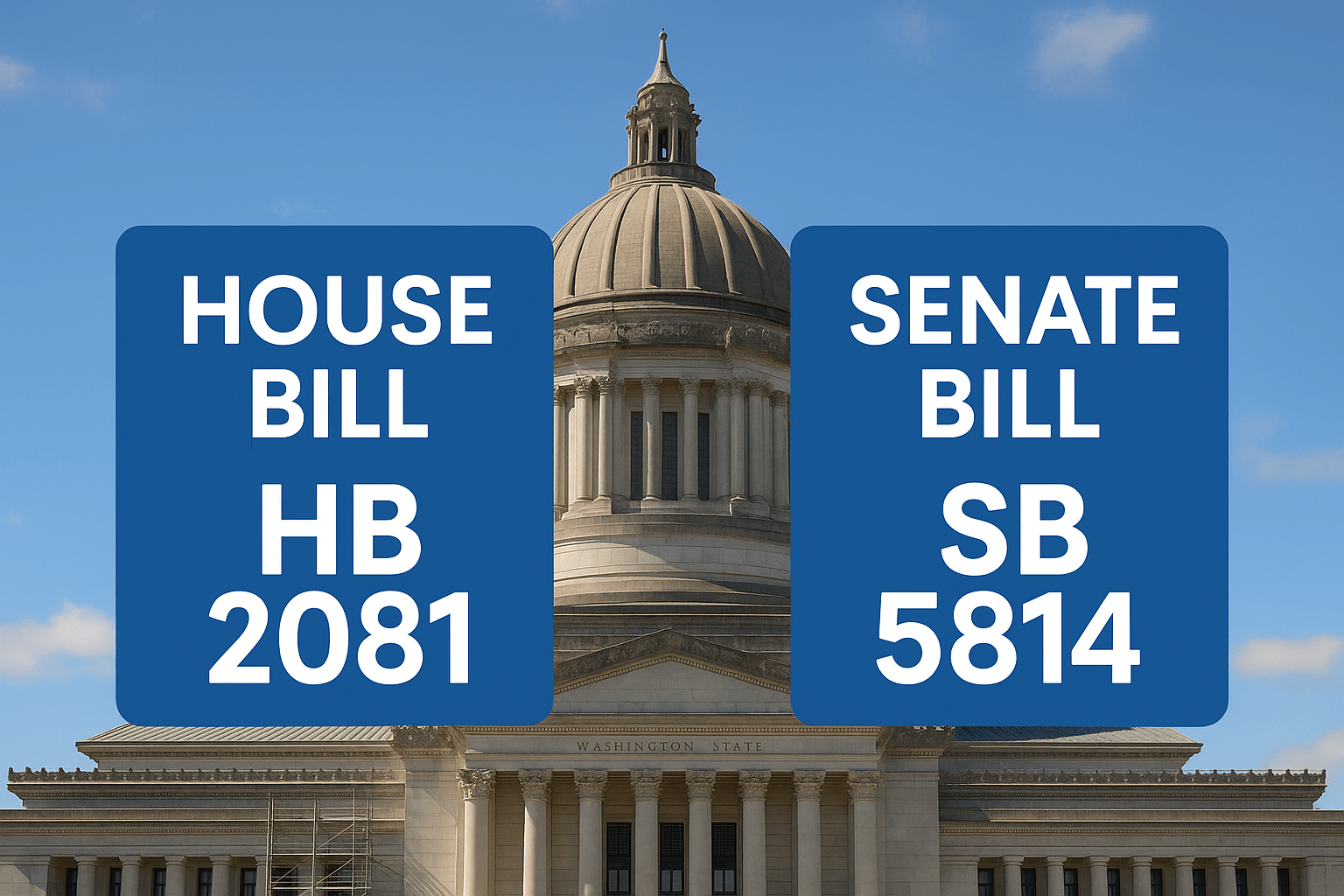

Existing Contracts and Washington’s New Sales Tax Rules (ESSB 5814): What Your Business Needs to Do Now

Updated: August 29, 2025 • Effective date to watch: October 1, 2025 SOURCE: https://dor.wa.gov/laws-rules/interim-guidance-statement-regarding-contracts-existing-prior-october-1-2025-and-changes-made-essb Washington’s Department of Revenue (DOR) issued interim guidance explaining how to handle contracts signed before October 1, 2025 that continue past [...]

QUICKBOOKS: Client action required– Bank of America accounts require an update

Bank of America is updating bank account connections in QuickBooks Online. All current clients with an active Bank of America connection must update their connection in QuickBooks to stay connected. Otherwise, their Bank of America [...]

TIGTA Reports on Deferred Social Security Taxes and Finds Some Incorrect Penalties

During the height of the COVID-19 pandemic, many employers took advantage of relief measures that allowed them to defer the deposit and payment of the employer’s share of Social Security taxes. This provision was designed [...]

Now You Have to Collect Sales Tax, Now What?: Be Prepare, to Collect, and Report

For many business owners, the announcement that they now must collect sales tax can feel overwhelming. The rules may have changed because of new legislation, your business crossed a revenue threshold, or you expanded into [...]

Upcoming Sales Tax Changes in Washington State: ESSB 5814 Effective October 1, 2025

Overview On May 20, 2025, Governor Bob Ferguson signed ESSB 5814 into law. Beginning October 1, 2025, Washington State will significantly expand its retail sales tax to include a range of services previously exempt—this includes [...]