Edmonds and Lynnwood Now Have Washington’s Highest Sales Tax Rate

Edmonds and Lynnwood Now Have Washington’s Highest Sales Tax Rate LYNNWOOD, Wash. — Shoppers and businesses in Edmonds and Lynnwood will soon be paying the highest combined sales tax rate in Washington State, as both [...]

A Helpful Filing-Season Reference: Retroactive 2025 Tax Deduction and Planning Opportunities

A Helpful Filing-Season Reference: Retroactive 2025 Tax Deduction and Planning Opportunities As tax season approaches, there are still several opportunities to reduce your 2025 tax liability—even after the calendar year has closed. Below is a practical [...]

Tacoma Approves New 0.1% Public Safety Sales Tax: What Clients Should Know

Tacoma Approves New 0.1% Public Safety Sales Tax: What Clients Should Know The City of Tacoma City Council has approved a new 0.1% Public Safety Sales & Use Tax, sometimes referred to as the Criminal [...]

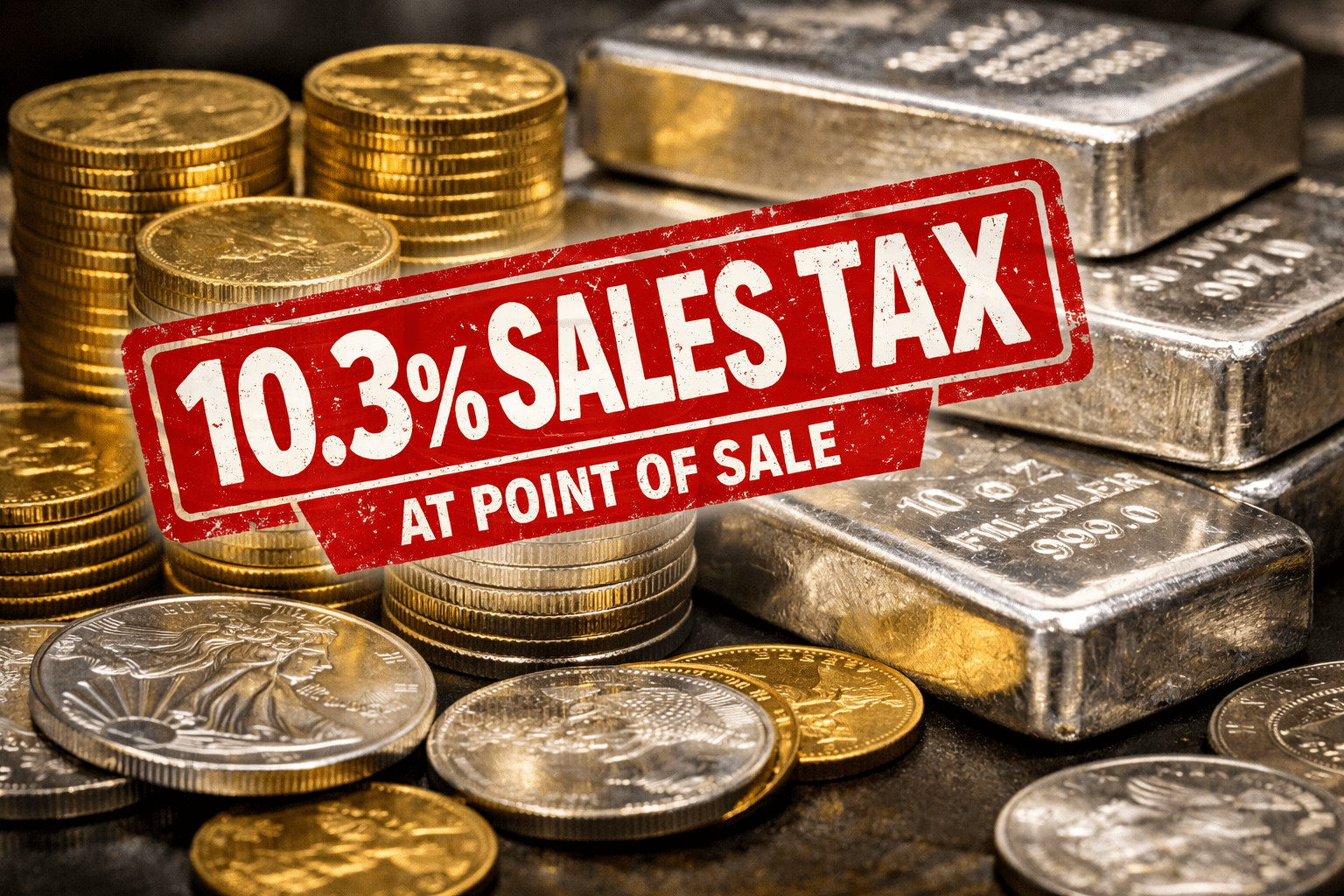

Washington State Ends Sales Tax Exemption on Precious Metals: What This Means for You in 2026

Effective January 1, 2026, a long-standing tax rule in Washington quietly but significantly changed. The state repealed its decades-old sales tax exemption on gold, silver, and other precious metal bullion and coins, meaning these purchases [...]

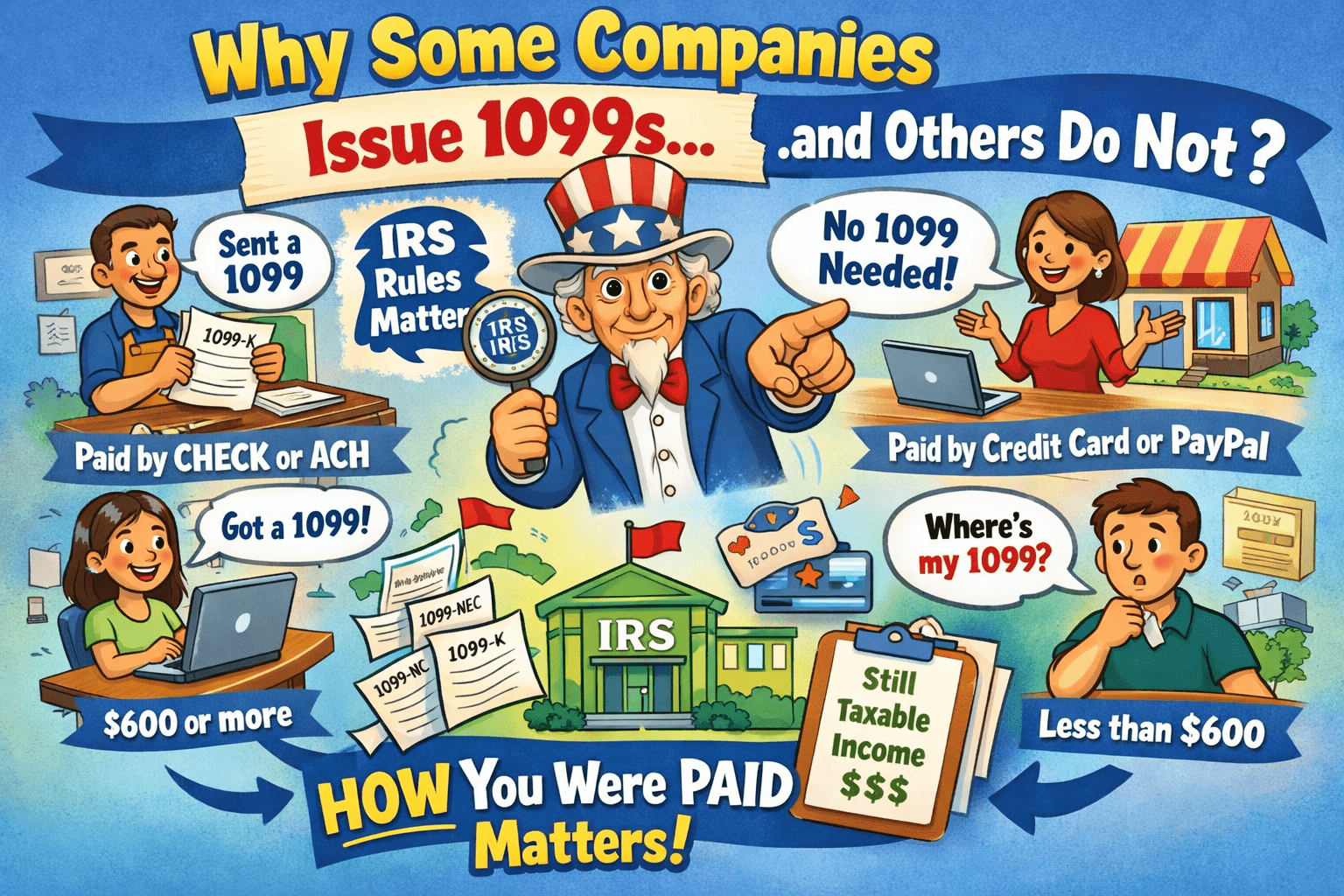

Why Some Companies Issue 1099s — and Others Do Not

Every year, right around January and February, the same question starts popping up from business owners and independent contractors alike. Someone will call or email and ask, “Why did one company send me a 1099, [...]

January 1 Checklist: Payroll Compliance

January Payroll Compliance Checklist Washington Employers January 1 changes take effect immediately. Employers should complete the following before or during their first payroll run of the year. Payroll System & Rate Verification Confirm all payroll [...]