HB 2100: Payroll Tax Changes Under Consideration in Washington State

House Bill 2100 recently received a public hearing in the Washington State House Finance Committee. The proposal, sponsored by Shaun Scott, would create a new payroll tax affecting certain medium and large employers operating in [...]

Edmonds and Lynnwood Now Have Washington’s Highest Sales Tax Rate

Edmonds and Lynnwood Now Have Washington’s Highest Sales Tax Rate LYNNWOOD, Wash. — Shoppers and businesses in Edmonds and Lynnwood will soon be paying the highest combined sales tax rate in Washington State, as both [...]

A Helpful Filing-Season Reference: Retroactive 2025 Tax Deduction and Planning Opportunities

A Helpful Filing-Season Reference: Retroactive 2025 Tax Deduction and Planning Opportunities As tax season approaches, there are still several opportunities to reduce your 2025 tax liability—even after the calendar year has closed. Below is a practical [...]

Tacoma Approves New 0.1% Public Safety Sales Tax: What Clients Should Know

Tacoma Approves New 0.1% Public Safety Sales Tax: What Clients Should Know The City of Tacoma City Council has approved a new 0.1% Public Safety Sales & Use Tax, sometimes referred to as the Criminal [...]

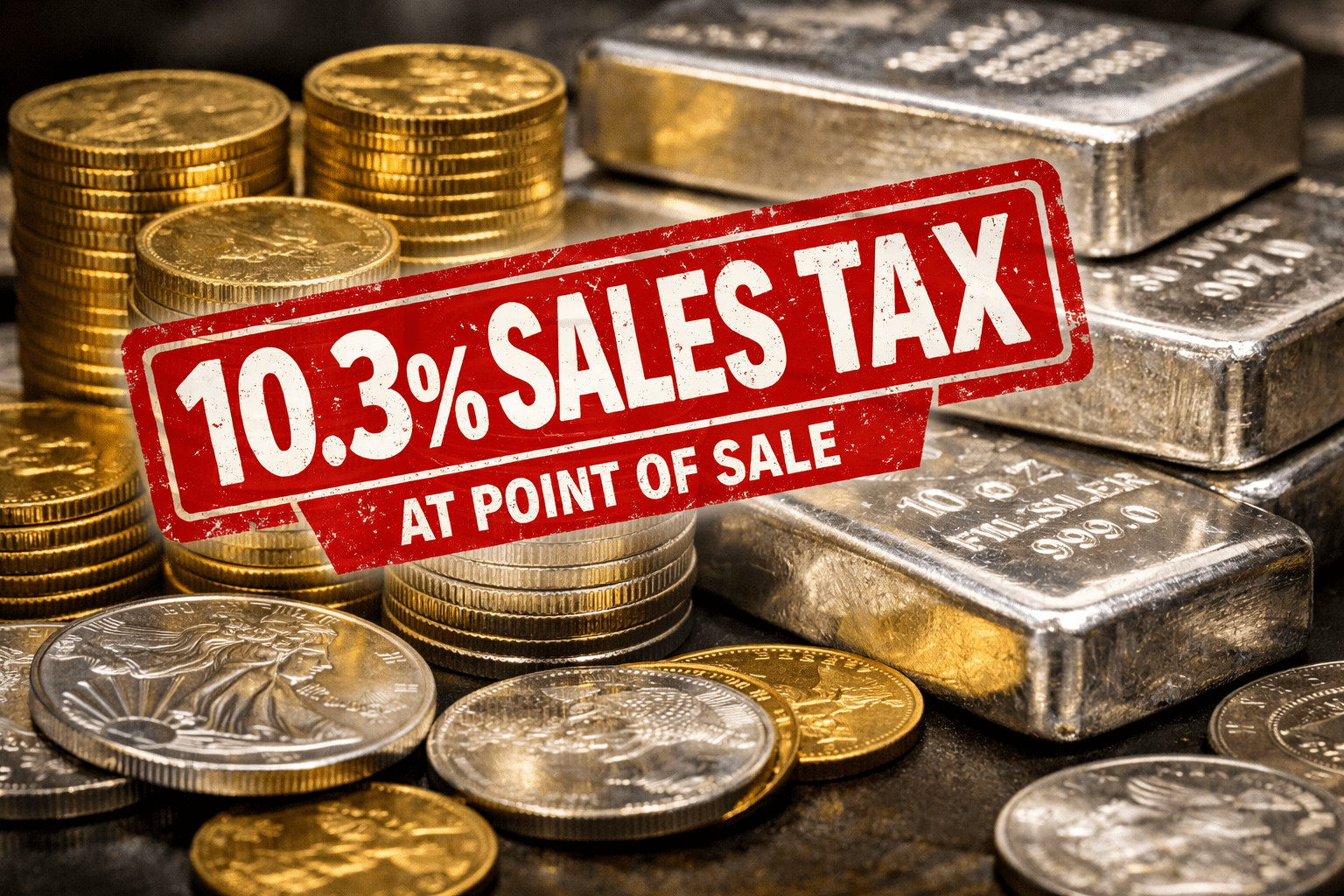

Washington State Ends Sales Tax Exemption on Precious Metals: What This Means for You in 2026

Effective January 1, 2026, a long-standing tax rule in Washington quietly but significantly changed. The state repealed its decades-old sales tax exemption on gold, silver, and other precious metal bullion and coins, meaning these purchases [...]

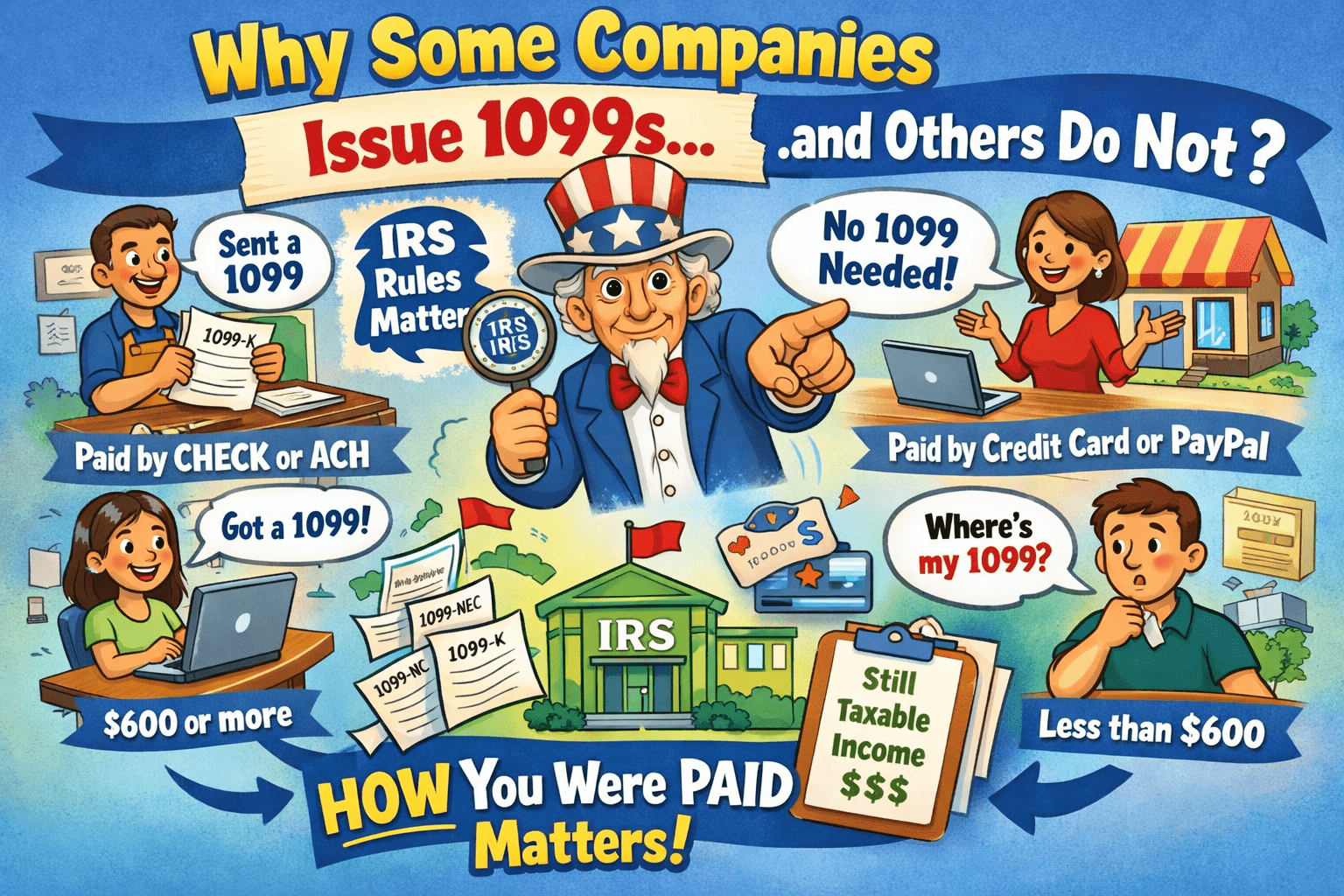

Why Some Companies Issue 1099s — and Others Do Not

Every year, right around January and February, the same question starts popping up from business owners and independent contractors alike. Someone will call or email and ask, “Why did one company send me a 1099, [...]